In this journal entry, the company deducts $1,300 from the inventory balances and recognizes it as the cost of goods sold immediately after making sale on October 15, 2020. Likewise, the company can check the inventory account immediately and will see that the inventory balances are reduced by $1,300 after this transaction. While perpetual inventory systems offer rich information for management, maintaining these systems is costly and time-consuming, unless the firm has completely computerized its inventory control system.

Which of these is most important for your financial advisor to have?

Finally, when you finish the product using the raw materials, you need to make another journal entry. Let’s take a look at a few scenarios of how you would journal entries for inventory transactions. A physical inventory count is usually taken once each year, although in some cases it may be done quarterly or even more frequently. A periodic system is only helpful if the business is small-scale and the inventory count is low, or if the employees are inexperienced in handling modern computers and networking technologies. Similarly, every package that is dispatched is scanned by barcode and loaded onto a vehicle. This reduces the inventory level and removes their records from the accounts.

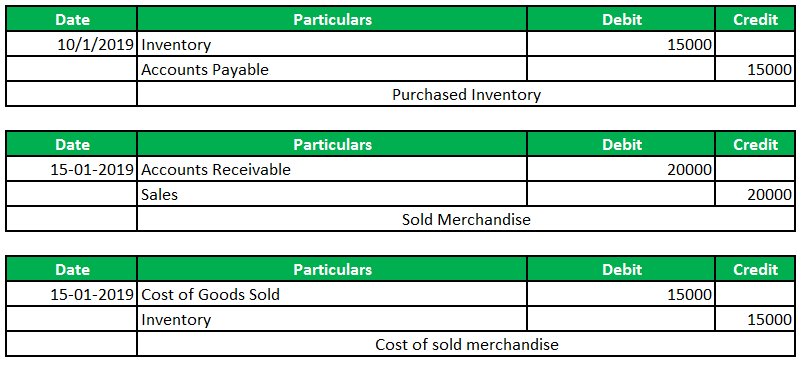

Inventory journal entries

The Metro company uses net price method to record the purchase of inventory. Traditionally, the perpetual inventory system was used by companies that buy and sell easily identifiable inventories such as jewellery, clothing and appliances etc. However, advanced computer software packages have made its use easy for almost all business situations and the companies selling any kind of inventory can now benefit from the system. A cash purchase of inventory results in a decrease in the Cash account, impacting the cash flow statement by reducing the cash available for operations and other activities. The method of payment (cash or credit) influences which accounts are involved in the transaction.

Overview of Inventory Accounting

- Raw material costs are the necessary expenses incurred to manufacture a product and include the purchase of any raw materials, parts, and components that go directly into making a product.

- While perpetual inventory systems offer rich information for management, maintaining these systems is costly and time-consuming, unless the firm has completely computerized its inventory control system.

- Perpetual inventory system and period inventory system are the two methods of accounting for inventory that is different from one to another.

- Incorrect inventory valuation can distort gross profit, operating income, and net income, potentially misleading stakeholders about the company’s performance.

- Inventory valuation adjustments may be required if the market value of inventory falls below its cost.

- An inventory write-down adjusts the book value recorded on the balance sheet for given inventory to match its current market value.

That concludes the journal entries for the basic transfer of inventory into the manufacturing process and out to the customer as a sale. There are also two special situations that arise periodically, which are adjustments for obsolete inventory and for the lower of cost or market rule. There is also a separate what is the difference between the current ratio and the quick ratio entry for the sale transaction, in which you record a sale and an offsetting increase in accounts receivable or cash. A sale transaction should be recognized in the same reporting period as the related cost of goods sold transaction, so that the full extent of a sale transaction is recognized at once.

If the actual loss is lower than the estimated expenses, the company already record expense more than it should be. The expense will record in the income statement and we cannot change the expense as it has already closed the report. It is the accounting estimate which depends on the company’s best estimation. On 31 Mar 202X, management needs to record inventory write-down expenses based on the management estimation.

Importance of Accurate Inventory Journal Entries:

By following these best practices, businesses can maintain accurate inventory records and reduce the risk of errors and fraud. Accurate inventory records can help businesses to make informed decisions, improve financial performance, and comply with tax reporting requirements. The lower-of-cost rule states that a business inventory accounting journal entry must record inventory at the lower of cost. If you buy $100 in raw materials to manufacture your product, you would debit your raw materials inventory and credit your accounts payable. Once that $100 of raw material is moved to the work-in-process phase, the work-in-process inventory account is debited and the raw material inventory account is credited. By meticulously recording inventory purchases, a business can maintain accurate financial records, essential for analyzing its financial health, making informed decisions, and reporting to stakeholders.

Inventory reserve is the inventory contra account that is used for direct inventory write-off. The perpetual vs periodic inventory system journal entries diagram used in this tutorial is available for download in PDF format by following the link below. It is a record of the movement of inventory items in and out of the company’s possession, as well as any adjustments made to the inventory account.

Perpetual inventory is an accounting method that records the sale or purchase of inventory through a computerized point-of-sale (POS) system. With perpetual inventory, you can regularly update your inventory records to avoid issues, like running out of stock or overstocking items. For businesses in which transactions such as purchasing, selling, and moving inventory happen every second, perpetual inventory systems are invaluable in helping to keep track of what is going on at all times.

The company needs to assess the inventory to provide an allowance of provision. It allows the company to record expenses before the inventory is actually written off, so the expense will spread over the financial statement. It will prevent the expense from hitting a particular accounting period and cause a significant impact on profit.